The Of Frost Pllc

The Of Frost Pllc

Blog Article

Frost Pllc for Dummies

Table of ContentsThe Only Guide for Frost PllcFrost Pllc Can Be Fun For EveryoneThe Only Guide for Frost PllcRumored Buzz on Frost PllcFascination About Frost PllcFrost Pllc Fundamentals ExplainedNot known Factual Statements About Frost Pllc

And aligning your group in the direction of general goals should not be ignored. Have regular meetings with personnel to track and report your development. Experiencing the motions of change is terrific, however without a technique of measurement, monitoring your progression and coverage, it's hard to recognize what's functioning and what isn't. You are the leader.These certifications will offer you the expertise you need to run your firm successfully and comfort prospective clients that you recognize what you're doing. Certifications are not the like experience. Having at the very least a few years of book-keeping job under your belt is valuable prior to you start out by yourself.

A tax number is important for all companies. These are simple to obtain as part of business registration procedure. The precise quantity you will require to get your firm up and running depends substantially on the range of the operation you're planning. Establishing up a book-keeping firm for relatively little preliminary outlay is possible, especially when you make use of software application registration solutions instead than acquiring software outright.

Frost Pllc Can Be Fun For Anyone

One of the very first things that prospective customers will certainly desire to be guaranteed of is that you are using top-of-the-range, safe and secure, sophisticated, and reliable audit tech. An expense management alsol will allow you track billable expenditures, configure spending plans for each task and track spend versus them, and specify project regulations and plans to guarantee compliance.

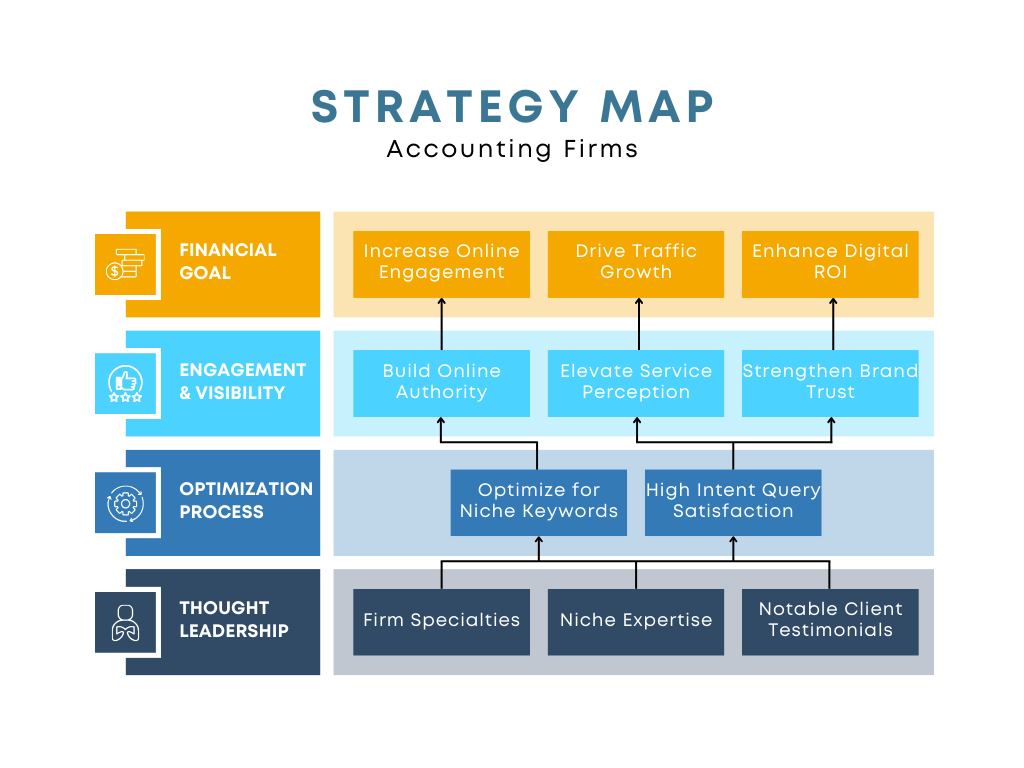

Through an excellent advertising and marketing and branding method, you can: Build awareness concerning your bookkeeping firm. Keep and improve partnerships with present customers. It can be appealing to market on the go, with the periodic press release or social media post as the chance develops.

With approach, you can grow your service and online reputation a lot faster than would otherwise hold true, with much less threat than would certainly or else be the situation. The expense of starting an accounting firm relies on highly variable factors, consisting of where you are in the globe, prevailing advertising problems, and the solutions you plan to offer.

6 Easy Facts About Frost Pllc Explained

As your company grows, added insurance coverage like Work Practices Liability Insurance Policy (EPLI) and workers' settlement insurance will contribute to your expenditures. The price of leasing workplace varies significantly depending on location and size. If you select to rent out, you'll need to budget plan for utilities, cleaning the original source up solutions, vehicle parking, and office style.

Efficient branding and marketing are crucial to drawing in customers. Costs can vary from basic pay-per-click (PAY PER CLICK) advertising to more intricate branding techniques entailing customized logos, internet sites, and marketing materials. Considering all these variables, the price Resources of starting an accountancy company can vary from as low as $2,000 to over $200,000, depending on the range and intricacy of your procedure.

Start with basic accounting, tax prep work, or payroll services. The bookkeeping area regularly advances, and remaining updated with the most current advancements is vital.

Word of mouth is one of the most usual means for book-keeping companies to acquire brand-new customers, as depend on and credibility play such a fundamental part in accountancy. However, there are ways to make sure that word ventures out regarding you and your firm. For instance: in your neighborhood through specialist talking engagements, supplying sponsorships, believed management campaigns, and typically obtaining your face around.

Top Guidelines Of Frost Pllc

Pals, family, and customers are all fantastic areas to begin when collecting brand-new customers. Most bookkeeping companies look for a mix of technical abilities, experience, and soft skills.

These qualifications show a strong understanding of accounting principles and guidelines. Previous experience in bookkeeping, particularly in a company setup, is extremely valued. Companies try to find prospects that have a proven record of managing economic declarations, income tax return, audits, and other bookkeeping tasks. Expertise of accounting software and tools, such a copyright, Netsuite or Sage, or specialized tax obligation software, is commonly needed.

:max_bytes(150000):strip_icc()/accountant.asp-FINAL-1-1-e83d0f7de3b848ada757ac5b9af16b72.png)

About Frost Pllc

It's crucial to approach it with the same degree of professionalism and reliability and dedication as any various other organization endeavor. There's a lot to think of when you start an accounting company. But by making note of the guidance in this write-up, you can get your new accountancy company off to a flying start.

As soon as you cover these bases, you'll be prepared to start developing discover here a name on your own in the bookkeeping world.

Contact other expert company and organizations similar to your own for suggestions on CPAs and/or audit companies - Frost PLLC. Not all auditors have not-for-profit experience, so you ought to check references and ask for a duplicate of their Peer Testimonial (most states call for auditors to be investigated themselves by a 3rd event, which is called a "peer testimonial")

Some Known Factual Statements About Frost Pllc

This is where the not-for-profit can help manage several of the expenses of the audit! Research companies that stand for the accounting career in your state, such as your State Board of Book-keeping, to help you figure out exactly how to evaluate the CPA/audit firm, based on criteria that CPAs are anticipated to comply with in your state.

Request a proposal letter from qualified Certified public accountant firms. Ask for referrals from other tax-exempt, charitable not-for-profit clients, and call those referrals. Don't be satisfied with the first three the audit firm gives you.

Report this page